Save $1M on just 2,000 loans by adopting Decision Management

We all saw it coming. Interest rates are rising and volumes of both refinances and purchases are declining. Anyone who’s been in the mortgage industry long enough has seen this movie before, right? Except… this year, we may need to throw out the old script. The Great Resignation, work from home, and a booming real estate market with limited inventory and eye-popping bidding wars are signs that the industry needs to rethink some fundamental assumptions.

In “normal” times, the usual response to slipping volumes and shrinking margins has been to market aggressively, targeting underserved markets with niche products, or undertaking ambitious IT projects to gain a productivity edge. Players without the resources or staying power exit unprofitable sectors, consolidate, and retrench. And because our industry is still labor intensive despite the move to digital, lenders shed headcount as margins get squeezed. But we’re not in a period of business as usual anymore.

A new approach is needed to tackle longstanding issues impacting profitability

Let’s start by tackling the issues of quality gaps and lagging productivity that work in tandem to drive up the cost per mortgage. Complex and frequently changing underwriting policies lead to process inconsistencies and errors requiring rework. Lenders take a hit on productivity and require post-closing staff to correct errors.

But throwing people at the problem, especially for quality checks, has not been effective. Post-close departments allocate significant resources to fixing quality issues. That needs to change. We have seen that a high percentage of quality related errors can be eliminated entirely by using decision management.

Decision management decreases your cost per loan through improved productivity and quality

Lenders adopt decision management in different ways, but common approaches can be identified using a simple “People, Process and Technology” framework commonly used in transformation projects.

With decision management in place, business logic for lenders, whether handled manually today in checklists or buried deep in hard to manage application code, becomes more accessible, transparent, and auditable. Consistently interpreted business policies allow quality to be automated. Productivity increases because underwriters don’t get slowed down by interpreting complex rules or having to rely on spreadsheet tools. Resources assigned to post-close quality checks can be rationalized and reassigned to higher value work.

Even the smallest lenders can save big

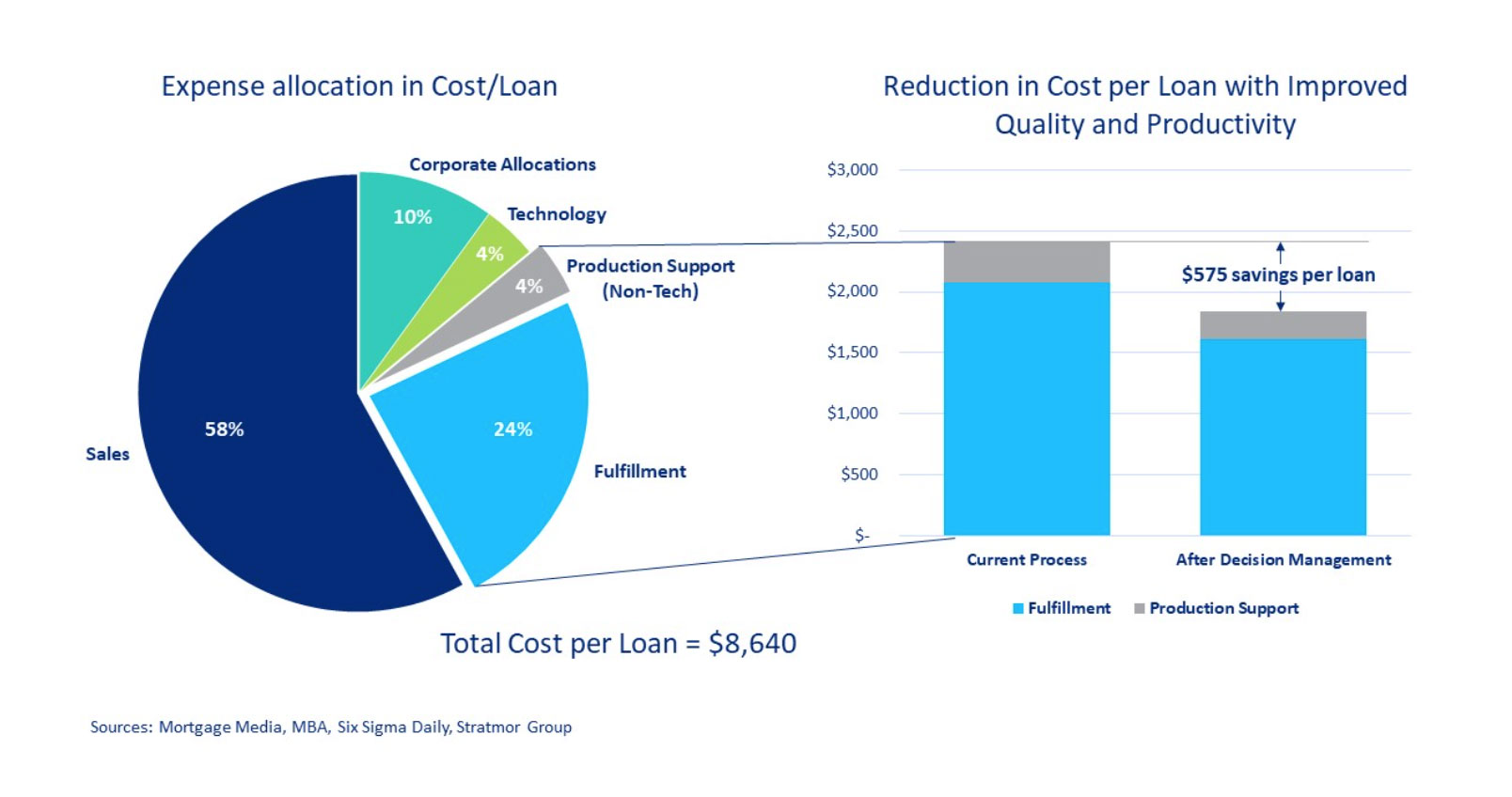

We have seen from our own clients’ experience how decision management dramatically reduces quality errors and boosts productivity. Based on industry benchmarks, lenders save an average of $575 on their cost per loan through labor savings in Fulfillment and Production Support alone. We account for savings through less rework, limiting non-value added activities and reducing the cost of errors.

Savings add up quickly and are significant. Even lenders with smaller volumes stand to gain – a mortgage originator underwriting just 2,000 loans per year can save over $1 million. The bottom line is that adopting decision management practices reduces your cost per loan dramatically, especially as volumes increase.

Decision management can wipe out the quality and productivity challenges that put a drag on lender profitability. Maintain your current processes and infrastructure and use decision management to ensure complex and changing business policies are implemented quickly and consistently. Now is the time to rewrite the mortgage industry script and become the hero of your own story.