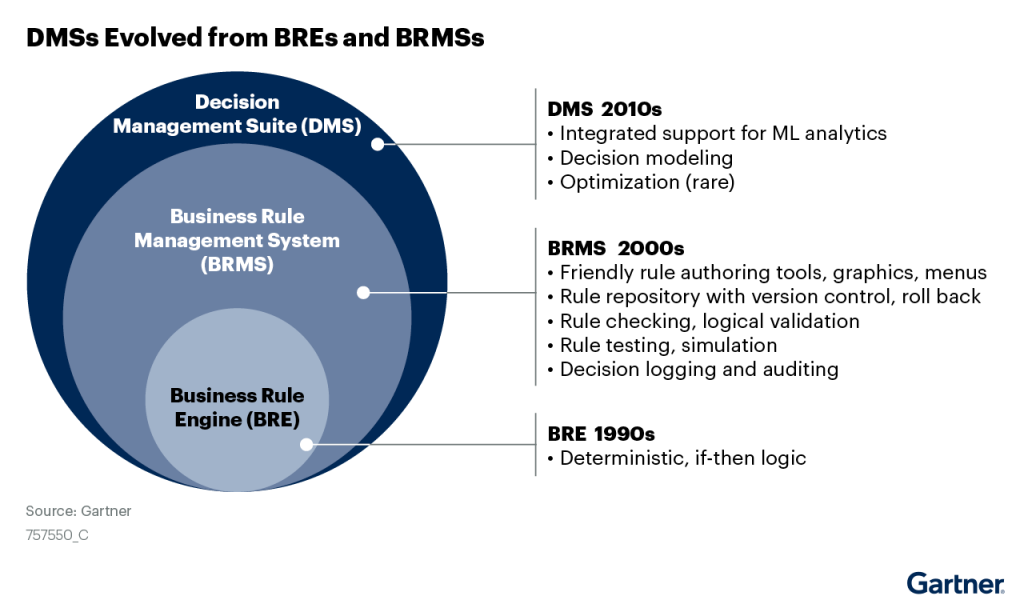

Gartner recently posed the question, “Are business rule engines obsolete?” Their report goes on to say that current Business Rules Management Systems (BRMS) are losing ground to Decision Management Systems (DMS), which take a more holistic view of the decision process, work with Machine Learning (ML) solutions and provide optimization capabilities.

This blog captures the key points from Gartner along with our own observations and research. But as everyone in the industry knows, traditional rules engines are as dead as that old flip phone all of us seem to have in the back of the junk drawer. Make way for Decision Automation.

What are business rules?

Business rules make companies run. Embedded in applications, business rules ensure insurance carriers make the right decisions consistently, and reflect the appropriate policies and regulations. Although it sounds simple, business rules can get complicated, especially in processes like underwriting where business conditions and regulations change frequently, and rules need constant updating.

Rules management is evolving quickly

Modern BRMS have made it easier for IT to make updates. Easy to use tools for authoring, version control, rule testing and auditing are all standard features. But BRMS still have shortcomings in their design and practical usage that prevent companies from managing their rules as a true business asset.

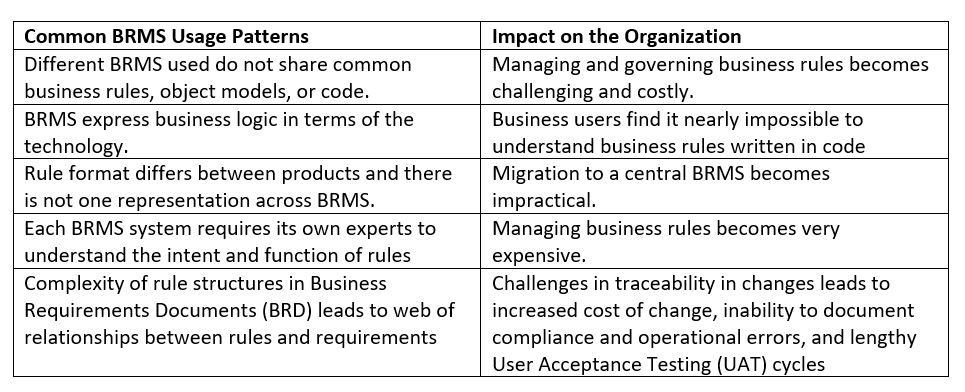

We have documented findings on BRMS gaps from our own research in the table below. For more information, read our whitepaper on differences between BRMS and DMS. Read more.

Table: Common issues with current Business Rules Management Systems (BRMS)

The next evolution of BRMS is evolving to address these challenges with the inclusion of decision management systems (DMS).

How does Decision Management work?

Decision management starts with an outcome, like renewing a policy without manual underwriting, and then considers all the facts and conditions necessary to make this determination. At the heart of DMS are decision models, created to simplify the complex and make it possible to understand conceptually by thinking about what needs to happen to implement a business policy.

Decision management separates decision logic from applications and makes it available to systems as a decision service. This separation allows business analysts with no coding skills to make changes directly with easy-to-use tools. Performant code is generated automatically by the DMS. Policy updates can be completed in minutes instead of months, and IT support for updates can be reduced up to 90%.

The big payoff occurs in situations where carriers are wrestling with spikes in claims, perhaps due to weather related events like wildfires or coastal flooding. Managing risk and reducing claim payouts often requires turning away new customers if deemed too risky. A DMS enables carriers to quickly implement risk related policy changes to fit their risk appetite under dynamic conditions.

DMS decision models, managed by business analysts as a corporate asset using no-code tools and bullet proof methodology, are essential in creating what we refer to as Decision Automation.

Decision Automation is a differentiator

Machine Learning (ML) used with decision automation is emerging as a potent combination in solving day-to-day operating challenges. As an example, a large P&C carrier applies ML to determine the risk level of automobile drivers and relies on its DMS to operationalize it. Drivers with a lower risk score established by ML are identified by the DMS, allowing the carrier to avoid purchasing expensive motor vehicle reports, and saving the company millions of dollars each year.

Decision automation can also be applied to deliver a streamlined user experience to customers combining the speed of automation with “live” customer service. Leading DMS have capabilities to optimize the decision algorithm to create the fastest path through an information gathering process, like initiating a claim. Receiving a positive experience during a claim is a “make or break” instance that has an outsize impact on brand loyalty.

Learn more about DMS

BRMS have come a long way, and with the inclusion of DMS, companies can drive more value from cost savings and faster time to market. Separating decision logic from technology collapses the update cycle, and no code tools enable business analysts to create updates with dramatically less reliance on IT. Decision automation has arrived.

So, if you are considering replacing an aging BRMS, take some time to understand the new decision management landscape… and maybe ditch the old phone while you’re at it.