Cash & Liquidity Optimization

Run treasury operations with today’s data, every day

Complex data requirements and business rules impact cash and liquidity management

Treasurers need accurate and timely information to optimize their cash and liquidity positions. But this can be a challenge due to data quality. Uncertain cash positions from timing differences and reconciliation of inaccurate data require treasurers to hold larger reserves. These problems prevent treasury operations from fully optimizing liquidity and freeing up cash.

Data and Process Challenges

- Rules for transforming data can be complex and error prone

- Timing and complex value dates create reconciliation issues

- Rules distributed across platforms have limited transparency and are difficult to audit

Impact on Cash and Liquidity Management

- Decisions are made using yesterday’s information

- Larger cash “cushions” need to be maintained due to uncertain cash positions

- Increased borrowing and transaction costs

- Greater potential for regulatory fines

- Staffing required for reconciliation

- Complex rules require IT development work for modifications

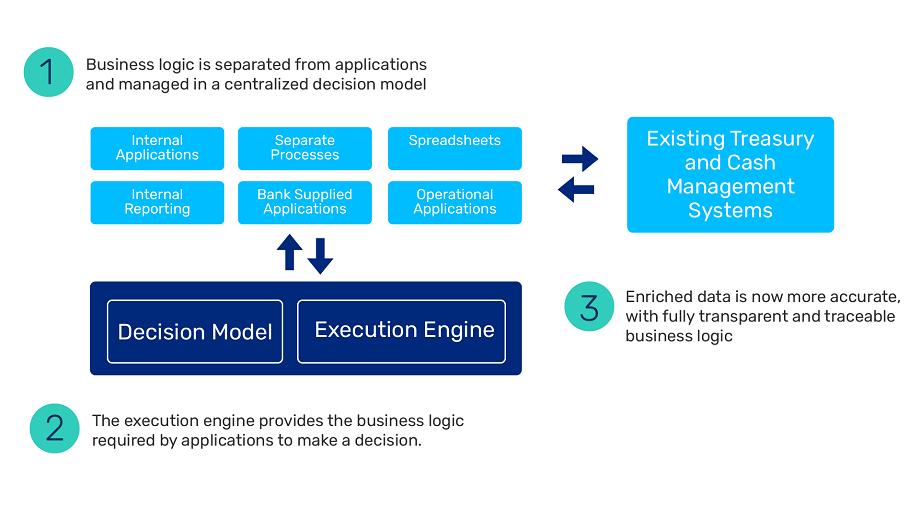

The Sapiens Decision solution addresses data and rules challenges within any existing treasury system environment

The result is cash and liquidity optimized to your needs

- Cash reserves can be decreased to generate higher ROI

- Headcount previously dedicated to reconciliation can be redeployed

- Regulatory reporting becomes more consistent with easily traceable business logic

- Cash & liquidity business logic is managed transparently and consistently across the firm

- Timing of flows is improved

Case Study: Global Bank optimizes cash & liquidity

Learn how a global bank optimized cash and liquidity while making data transformation rules more transparent and fully auditable

Get an overview of Sapiens Decision’s treasury solution designed to optimize liquidity and cash management